- Intellect

- Solutions

- Wealth Management Solutions

- Wealth Management-RM Office

eMACH.ai

Consumer Originations

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam

500+

60%

70%

99.8%

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Lorem ipsum

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam

Lorem ipsum

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam

Lorem ipsum

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam

Lorem ipsum

Lorem ipsum

Lorem ipsum

Modern Lenders Aspire to Deliver Excellence

While maintaining operational excellence and driving sustainable growth

Frictionless Experience

Seamless Lending Journeys

Design intuitive experiences from application to disbursement.

Scale Efficiently

Portfolio Growth

Expand into new segments while maintaining asset quality.

Collaborative Ecosystems

Partner Network

Build partnerships with fintechs, merchants, and service providers.

Automate & Optimize

Operational Excellence

Reduce costs through intelligent workflows and automation.

Regulatory Adherence

Compliance & Security

Built-in compliance frameworks and complete audit trails.

Risk Management

Precision Analytics

Assess risk accurately, price optimally, minimize defaults.

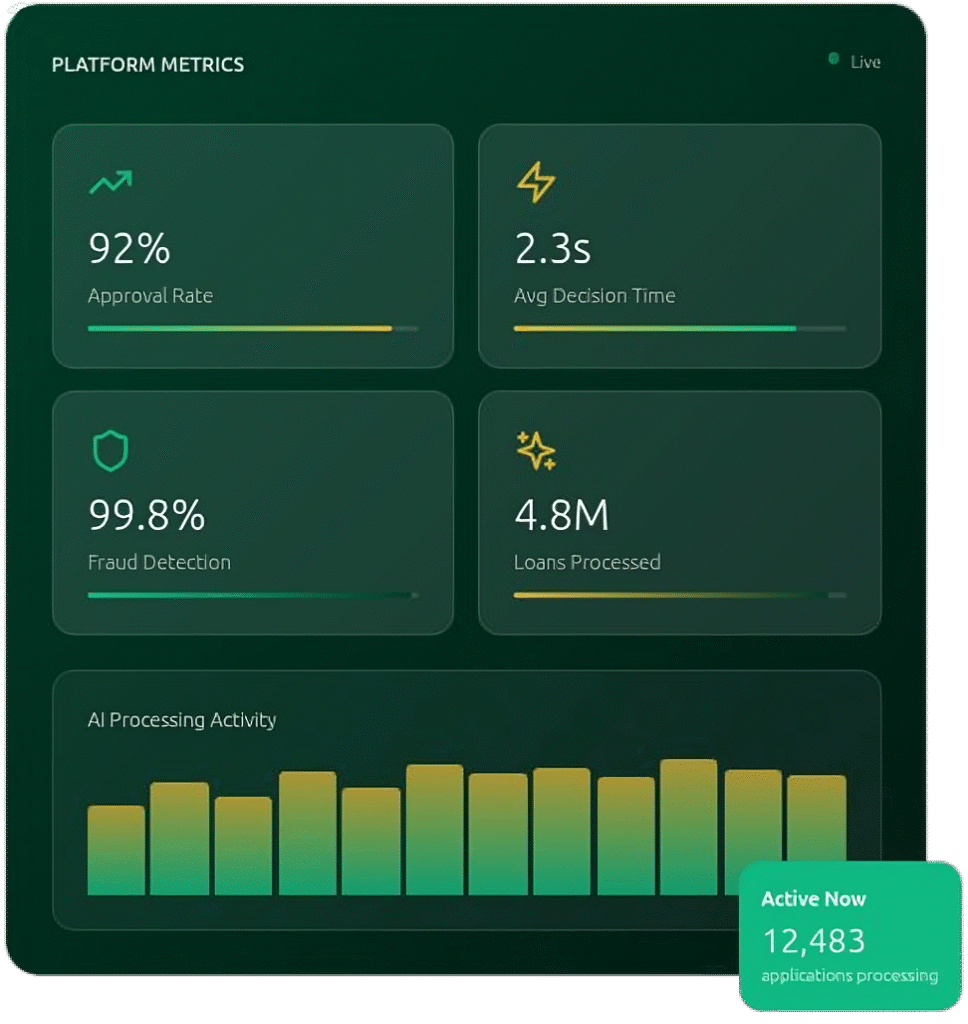

Fully Integrated AI-first Consumer Lending Suite

A unified platform for personal, auto, home, SME loans, and credit cards built to simplify originations, strengthen underwriting, and automate servicing at scale.

+40%

Ominichannel Origination

80%

AI Driven Underwriting

95%

Instant Disbursement

95%

End to End Servicing

Unlock Consumer Lending Portfolio Growth with eMACH.ai

Frictionless Origination

- Facial recognition, ID match using AI

- Liveness check, anomaly detection

- API-enabled embedded originations

- Zero-touch documentation

Powerful & Extensible

- Extensible process workflows

- Collateral and limit management

- User-defined fees, charges, repayment allocations

- Custom NPA classifications

AI-First Technology

- AI credit decisioning and underwriting

- AI operation controls

- Cloud-native, microservices architecture

- Event-based scalability

Complete Integration

- Extensible customer credit appraisal engines

- Seamless credit bureau integration

- KYC, AML, 3rd party ecosystem

- Fintech partnerships via APIs

Real-Time Risk Tracking

- Centralized risk tracking across credit lines

- Multi-dimensional exposure views

- Real-time margin tracking

- Proactive risk management

Optimize Recoveries

- Real-time loan performance analysis

- Intuitive collection score segmentation

- Customer-centric debt collection

- Streamlined policies

Capabilities That Transform Performance

Every RM gets their own AI team, working 24/7 to amplify expertise and maximize impact.

Product Configurator

AI Underwriting

Portfolio Analytics

Open APIs

Compliance

Risk Management

Why Leaders Choose RM Office

Measurable impact, proven results, trusted by the world’s leading wealth managers.

Advisor-First Experience

Built for RMs, not around them

- 80% prep time reduction

Explainable AI

- 100% transparency

Composable Design

- API-first architecture

Measurable Impact

Humanised Technology

- 95% adoption

Embedded Intelligence Driving Smart Banking

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit

Delivering Tangible Impact Across Global Banks

Bank A

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Bank B

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Bank C

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Recognized Excellence

Stay Informed with the Latest Insights

Insights contextual to only this solution/product from the Insights repository