- Intellect

- Solutions

- Cards Solution

- Consumer Cards

eMACH.ai

Consumer Cards

Launch in 8 Weeks

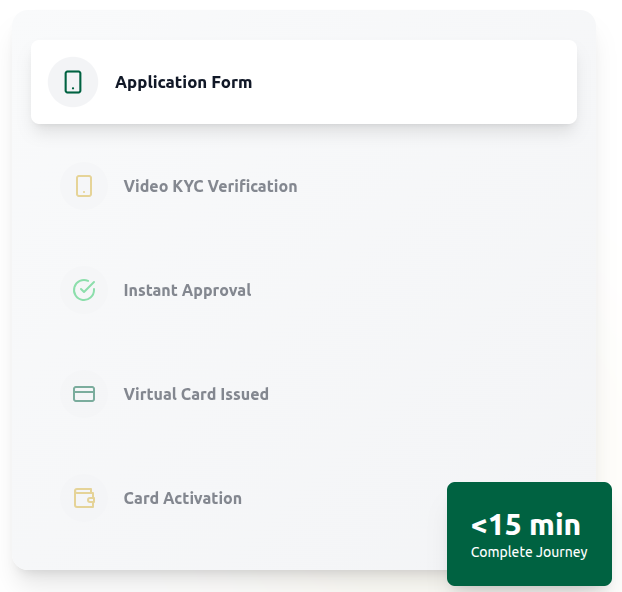

A compliance-first, modular platform that streamlines customer acquisition, speeds decisioning, and delivers instant virtual issuance.

100+

50+

99.9%

24/7

Digital services

The credit card landscape in India is being reshaped

Design your onboarding to win

₹30.1T Card Payments Market in 2025

108M active cards by Dec 2024 (doubled from 54M in 2019). 430M transactions/month (↑31% YoY). Market growing at 9.4% in 2025, 11.5% CAGR through 2029.

80% Drop-Off Reduction with AI-powered vKYC

Video KYC cuts onboarding to <15 min (vs. weeks manual). Pre-call time reduced 7X. Live call <3 min (vs. 8-10 min avg). AI fraud detection with 20+ real-time checks.

65% Still Tier-1 but Tier 2/3 growing fast

Strong growth in Surat, Nashik, Kanpur. 561.6M Jan Dhan accounts enabling rural access. Need multilingual support (20+ languages). Only 5-6% population has credit card.

70%+ Prefer Rewards, Cashback/points essential

Co-branded cards (Amazon Pay ICICI, Flipkart Axis, Tata Neu HDFC) rapid growth. Banks collaborating with fintechs. Tokenization + embedded finance dominant. 30% more likely to purchase with cashback.

₹107Cr Cyber Fraud FY25 Q1-Q3 losses

1.8% default rate. ₹2.70 lakh crore outstanding (from ₹87,686Cr in 2019). Delinquencies >360 days: 1.3%→1.7%. RBI tightening norms. AI fraud detection central.

Banks and issuers face frictions across the onboarding funnel

We tackle the top 5

1

High drop-off in Digital Applications

- Customers abandon when journeys feel long, repetitive, confusing

- Manual KYC took several weeks, causing midway abandonment

- Digital KYC, vKYC, live selfies, OCR checks – painful maze with no hand-holding

- Especially problematic in Tier 2 & 3 cities

2

Slow Time to Market

- Traditional vendor stacks require months to configure, test

- Cannot launch co-branded partnerships quickly

- Miss seasonal/festive launch windows

- Slow response to market opportunities

3

Legacy System Integration

- Most banks rely on older CBS, CMS, workflow engines

- Integration complexity prevents modern overlay

- Disruption risk when touching core systems

- Vendor lock-in limiting innovation

4

Evolving Regulatory Compliance

- RBI compliance updates, KYC/vKYC norms continuously evolving

- Aadhaar masking, CKYC integration, consent architectures changing

- AML/CFT regulations, PCI-DSS standards

- Data privacy, localization requirements

Power your card business with an intelligent, future-ready CMS & onboarding engine

Our platform combines security, personalization, and automation into one modern, modular system. It delivers real-time card lifecycle management and smart fraud controls, enabling banks, fintechs, and co-brand partners to launch and scale differentiated card programs.

Deep personalization through configurable card experiences – spend limits, merchant category toggles, rewards logic, geolocation controls, tokenization settings. Customers instantly lock/unlock cards, activate travel modes, adjust preferences.

Pre-built connectors to core banking, HSM, networks (Visa, Mastercard, RuPay), AML systems, fraud engines. Deployment is fast and seamless.

+40%

Client Coverage

80%

Faster Reviews

95%

STP Rate

95%

Adoption

Six core capabilities transforming card onboarding & management

Instand Digital Onboarding

- Complete KYC <15 min

- Pre-call form-filling reduced 7X

- Live call <3 min

- Multi-lingual with live AI translation

- Low-bandwidth for Tier 2/3 cities

- Compatible 10,000+ devices

- Aadhaar e-KYC, PAN, face match, liveness detection

Low-code Decisioning

- Configure credit policies, risk rules, pricing without coding

- Real-time decisioning with AI credit scoring

- CIBIL + AI financial behavior analytics

- Automated approval workflows

- Multiple bureau, fraud system integration

- Support FD-secured, co-branded cards, BNPL

Instant Virtual Issuance

- Provision virtual cards immediately upon approval

- Tokenization for digital wallets

- Near-instant activation vs. days/weeks physical delivery

- Support contactless payments

- RuPay credit via UPI integration

Real-time Fraud & Risk

- AI fraud detection 20+ real-time checks during onboarding

- >Deepfake, spoof detection

- PAN–Aadhaar matching with tamper detection

- Face match, liveness detection

- Behavioral analytics, device signatures

- Pattern recognition, adaptive authentication

RBI Compliance Regulatory

- Pre-configured workflows for RBI KYC/vKYC guidance

- PCI-DSS standards support

- Aadhaar masking compliance

- CKYC integration, consent frameworks

- AML/CFT regulatory reporting

Hyper Personalisation

- Configurable spend limits, merchant category controls

- Geolocation restrictions, travel mode

- Dynamic rewards logic

- Behavioral insights, spending pattern analytics

- Personalized nudges for activation, first spend

- Real-time application status visibility

- Funnel analysis identifying drop-off stages

Instand Digital Onboarding

- Complete KYC <15 min

- Pre-call form-filling reduced 7X

- Live call <3 min

- Multi-lingual with live AI translation

- Low-bandwidth for Tier 2/3 cities

- Compatible 10,000+ devices

- Aadhaar e-KYC, PAN, face match, liveness detection

Low-code Decisioning

- Pre-configured workflows for RBI KYC/vKYC guidance

- PCI-DSS standards support

- Aadhaar masking compliance

- CKYC integration, consent frameworks

- AML/CFT regulatory reporting

Instant Virtual Issuance

- Provision virtual cards immediately upon approval

- Tokenization for digital wallets

- Near-instant activation vs. days/weeks physical delivery

- Support contactless payments

- RuPay credit via UPI integration

Real-time Fraud & Risk

- AI fraud detection 20+ real-time checks during onboarding

- Deepfake, spoof detection

- PAN–Aadhaar matching with tamper detection

- Face match, liveness detection

- Behavioral analytics, device signatures

- Pattern recognition, adaptive authentication

RBI Compliance Regulatory

- Pre-configured workflows for RBI KYC/vKYC guidance

- PCI-DSS standards support

- Aadhaar masking compliance

- CKYC integration, consent frameworks

- AML/CFT regulatory reporting

Hyper Personalisation

- Configurable spend limits, merchant category controls

- Geolocation restrictions, travel mode

- Dynamic rewards logic

- Behavioral insights, spending pattern analytics

- Personalized nudges for activation, first spend

- Real-time application status visibility

- Funnel analysis identifying drop-off stages

Six core capabilities transforming card onboarding & management

Lorem ipsum dolor sit amet, consectetur adipiscing elit

Instand Digital Onboarding

- Complete KYC <15 min

- Pre-call form-filling reduced 7X

- Live call <3 min

- Multi-lingual with live AI translation

- Low-bandwidth for Tier 2/3 cities

- Compatible 10,000+ devices

- Aadhaar e-KYC, PAN, face match, liveness detection

Low-code Decisioning

- Pre-configured workflows for RBI KYC/vKYC guidance

- PCI-DSS standards support

- Aadhaar masking compliance

- CKYC integration, consent frameworks

- AML/CFT regulatory reporting

Instant Virtual Issuance

- Provision virtual cards immediately upon approval

- Tokenization for digital wallets

- Near-instant activation vs. days/weeks physical delivery

- Support contactless payments

- RuPay credit via UPI integration

Real-time Fraud & Risk

- AI fraud detection 20+ real-time checks during onboarding

- Deepfake, spoof detection

- PAN–Aadhaar matching with tamper detection

- Face match, liveness detection

- Behavioral analytics, device signatures

- Pattern recognition, adaptive authentication

RBI Compliance Regulatory

- Pre-configured workflows for RBI KYC/vKYC guidance

- PCI-DSS standards support

- Aadhaar masking compliance

- CKYC integration, consent frameworks

- AML/CFT regulatory reporting

Hyper Personalisation

- Configurable spend limits, merchant category controls

- Geolocation restrictions, travel mode

- Dynamic rewards logic

- Behavioral insights, spending pattern analytics

- Personalized nudges for activation, first spend

- Real-time application status visibility

- Funnel analysis identifying drop-off stages

Why transformative issuers choose our card management platform

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod

Why transformative issuers choose our card management platform

Real-Time, Not Batch

Every capability operates in real time. Low-latency decisions for 430M monthly transactions. Seamless experiences during peak demand. Always-on performance, dependable uptime. Ready for instant payment rails, UPI credit integration.

Intelligence-First

Intelligence at foundation, not bolted on. Every transaction/event evaluated by unified risk engine. Behavioral analytics, device signatures, pattern recognition. Reduces false positives, enables adaptive authentication. AI-driven personalization shapes offerings.

Built for India

RBI-compliant KYC/vKYC pre-configured (not generic global platform). Multi-lingual with live AI translation (20+ languages). Low-bandwidth optimization for Tier 2/3 cities. Aadhaar, PAN, CKYC integration native. Support 10,000+ devices including budget smartphones.

Modular & Composable

Deploy full stack or individual modules. Plug-and-play on legacy CBS/CMS. Vendor-agnostic – use your own or ours. API-driven for rapid integration. Launch programs 8-10 weeks vs. months.

Proven at Scale

Powers 28% of India’s credit card originations. #1 Indian-headquartered processor. Top-3 global CMS provider. Tier-1 banks, fintechs, co-brand partners. Trusted across India, Southeast Asia, Middle East, Latin America.

Compliance Without Compromise

Every decision traceable, understandable, reviewable. Explainability, auditability meet global standards. AI logs every action for compliance review. Automation and compliance work together. Future-proof for evolving RBI, PCI-DSS, AML/CFT.

Customer Experience Excellence

Recognized by industry leaders for digital experience. DBS Card+: Silver MobEx Awards (11th Edition). Most Effective Credit Card App: Silver IDMA 2023. Best Mobile Banking App: Global Brands 2023. Not just processing – elevating digital experiences.

Embedded Intelligence Driving Smart Banking

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

- Lorem ipsum dolor sit amet

Delivering Tangible Impact Across Global Banks

Bank A

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Bank B

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Bank C

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Recognized Excellence

Stay Informed with the Latest Insights

Insights contextual to only this solution/product from the Insights repository

FAQs Frequently Asked Questions

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Lorem ipsum dolor sit amet consectetur adipiscing elit

Lorem ipsum dolor sit amet consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur.

Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.